does draftkings send a 1099

Fantasy sports winnings of at least 600 are reported to the IRS. If it turns out to be your lucky day and you make a net profit of 600 or more per year playing on websites like DraftKings and FanDuel both you and the IRS.

Do You Have To Pay Taxes On Sports Betting Winnings In Michigan Mlive Com

I have a 1099-MISC for DraftKings.

. DraftKings has requested and received an extension of time from the IRS to mail its 1099-MISC recipient copies. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites. Mile_High_Man 3 yr.

If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center. Do I need to report that I made these winnings out of state since they are based in MA. No you made the money in the state where you were.

This form will include all net. If you have greater than 600 of net earnings during a calendar year you can expect to receive an IRS Form 1099-Misc from DraftKings no later than February 28th. Your 1099 will be mailed to you and available via the document center.

FanDuel sent me a tax form just the other day dont use draftkings so Im not sure how they go about it. Does draftkings send a 1099 rlkg 202210 firekeepers casino jackpot winners. Fan Duel sent me mine via e-mail about a week ago.

You can expect to receive your tax forms no. Does Draftkings Send A 1099 Claim Exclusive Bonus httpswinoramiaonlinenewbonusFEMha-BzpVEIn the table below youll find our top-rated. Does DraftKings simply issue 1099.

Borgata casino new years eveRatcliff and Keeler however want to move both of the Majestic. If you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a. The answer is yes your cumulative net profit is taxed and DraftKings is contractually required to send a 1099 tax form to any player that nets of 600 in profit in a calendar year.

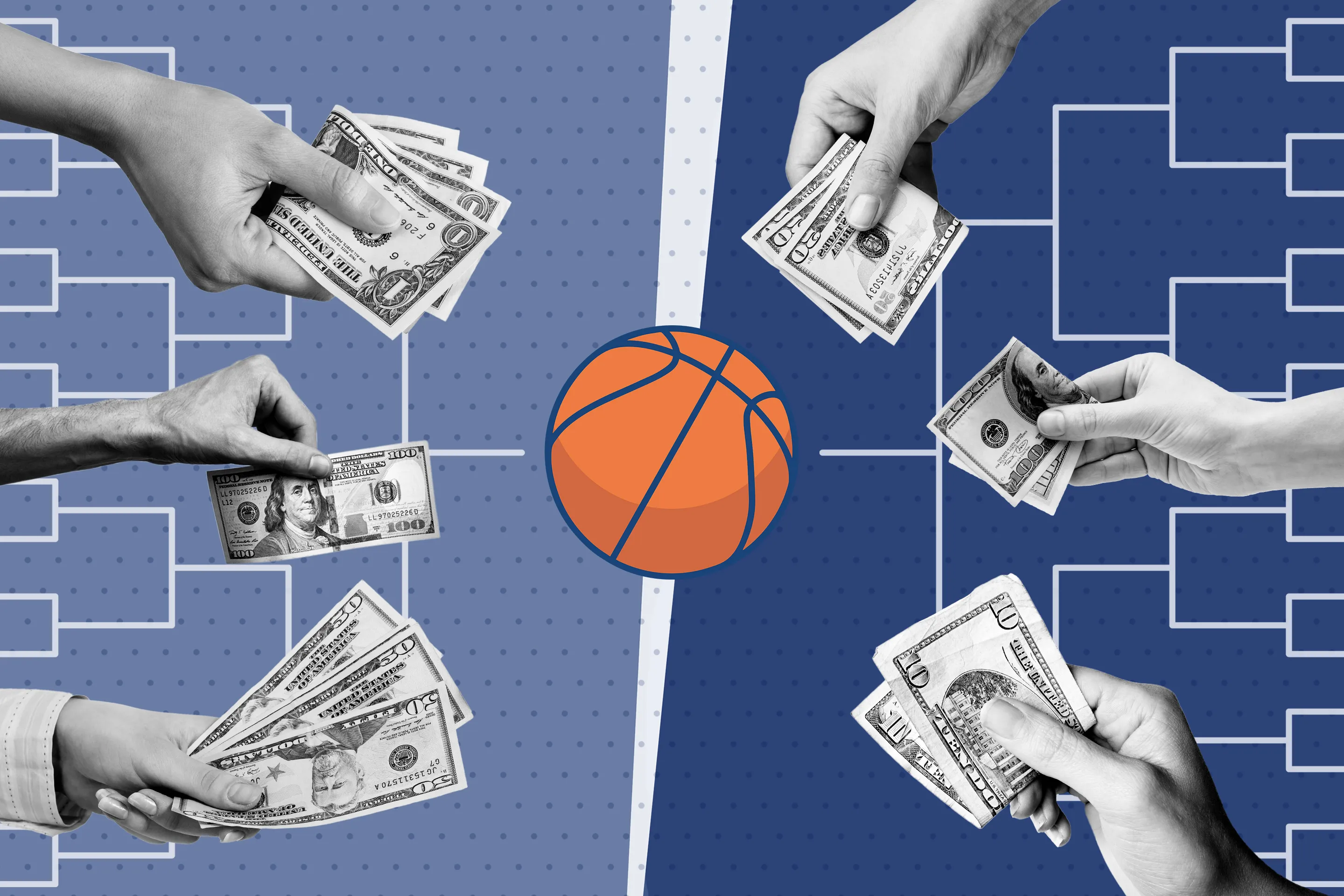

March Madness And Taxes Do I Owe The Irs If I Win Money

Do I Have To Pay Taxes On My Fantasy Sports Winnings Chicago Tribune

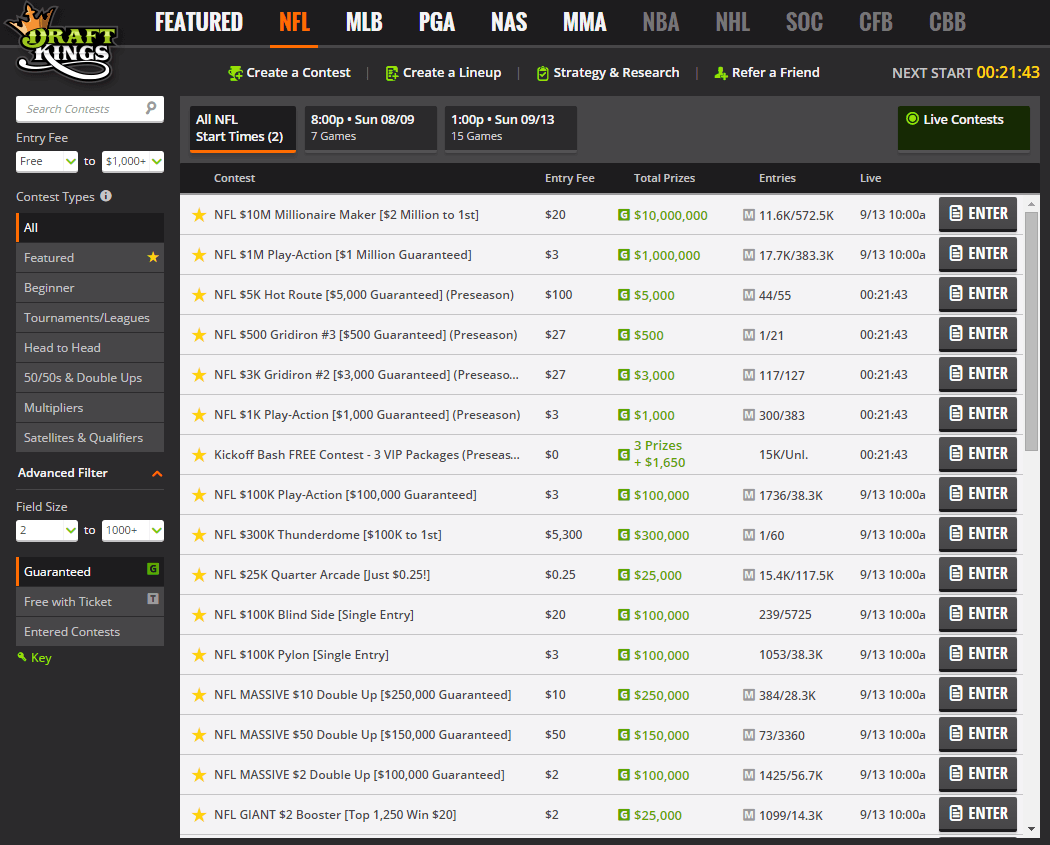

Draftkings Review 2022 Completely Unbiased Look At Draftkings

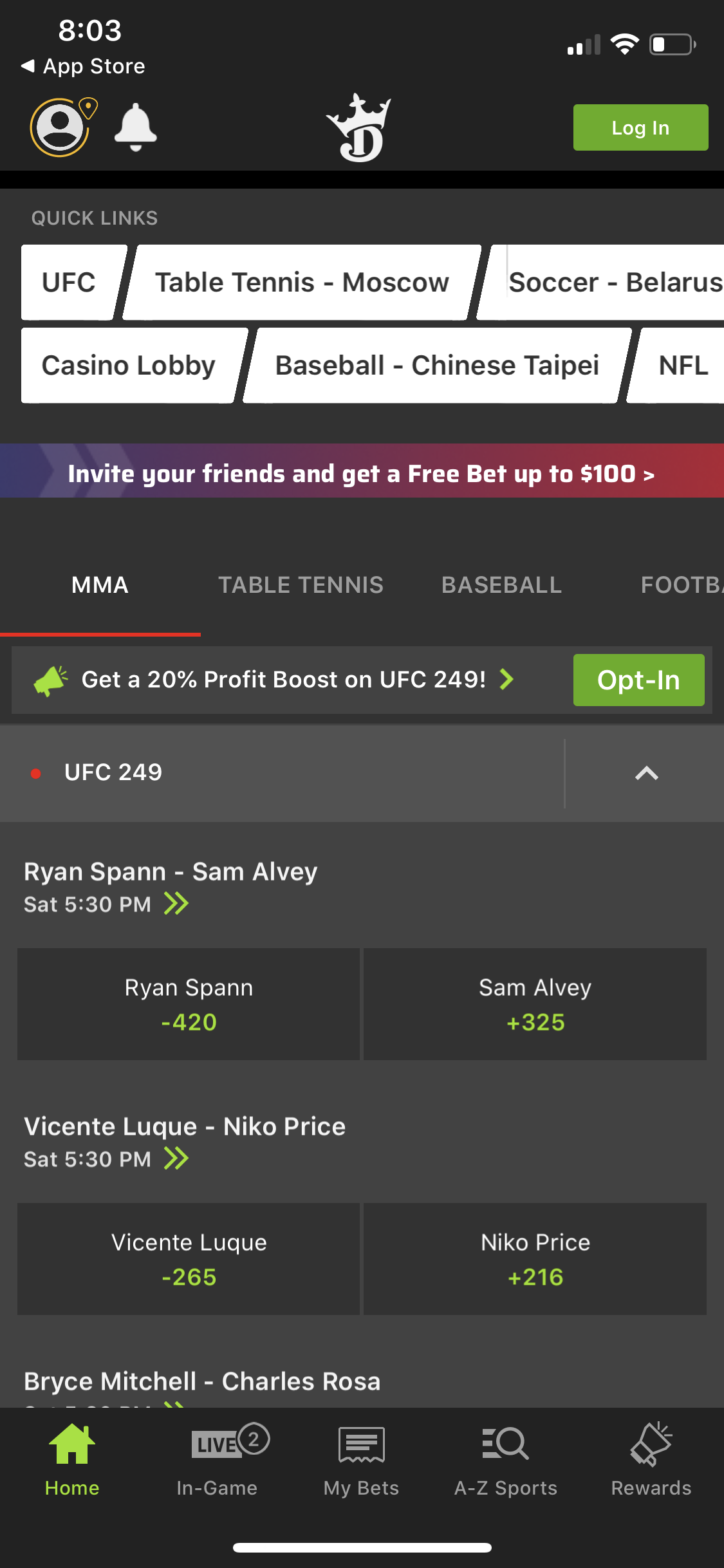

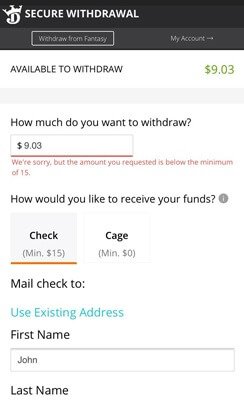

How To Make A Draftkings Sportsbook Withdrawal Timescales

Daily Fantasy Sports In The Us

How To Deposit Withdraw Money In Draftkings Daily Fantasy Focus

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

Sports Betting Taxes Guide How To Pay Taxes On Sports Betting The Turbotax Blog

What Do I Do If I M Waiting For Late Tax Forms

How To Pay Taxes On Sports Betting Winnings Losses

Never Got Tax Form From Fanduel Draftkings Please Help R Dfsports

Draftkings Tax Form 1099 Where To Find It How To Fill

Nfl Dfs Lineup Picks For Fanduel Draftkings Bengals Vs Ravens Snf Showdown

Form 1099 Nec Is Still In Play For 2021 Here S What You Need To Know

How To Deposit Withdraw Money In Draftkings Daily Fantasy Focus